Even as India’s exports register positive growth in August 2025 amidst global trade uncertainty and tariff wars, contraction of imports signalling weak demand, absence of frontloading, and inadequate export finance remain chief worries for industry and analysts ahead of tariffs hitting.

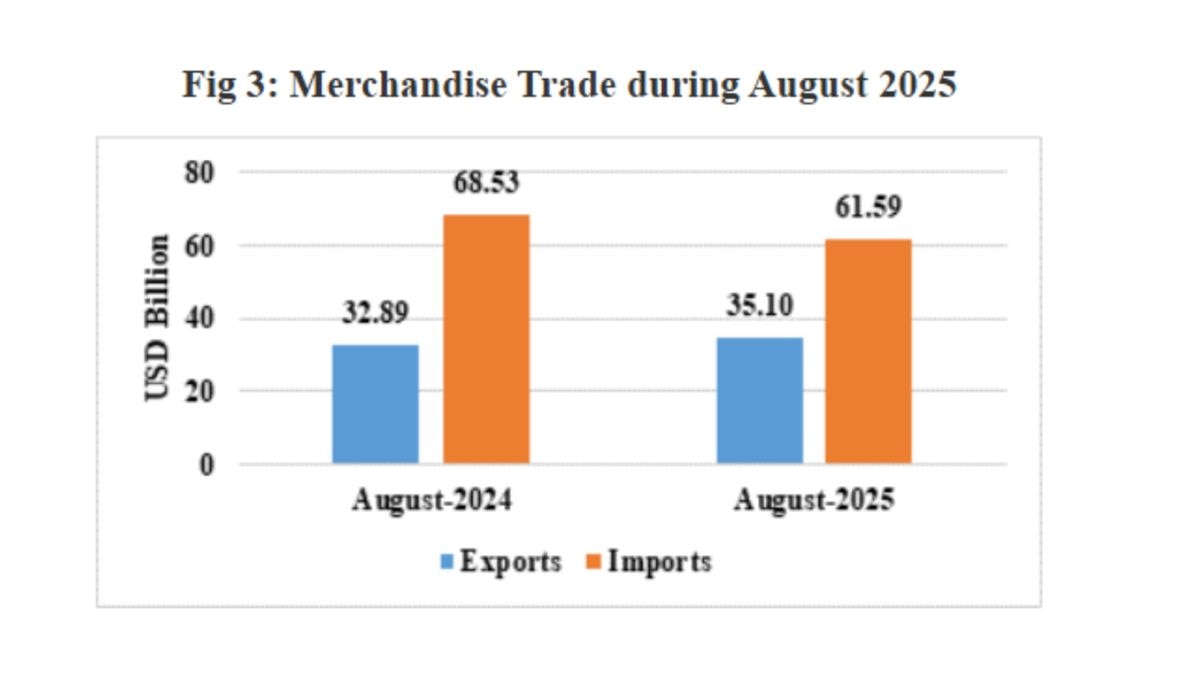

India’s merchandise exports in August 2025 rose by 6.7 per cent year-on-year to $35.10 billion, compared to $32.89 billion in August 2024. This surge took place even as growth in India’s exports to the US slowed down under the impact of the 25 per cent penalties, over and above the 25 per cent reciprocal tariffs which came into effect towards the end of August.

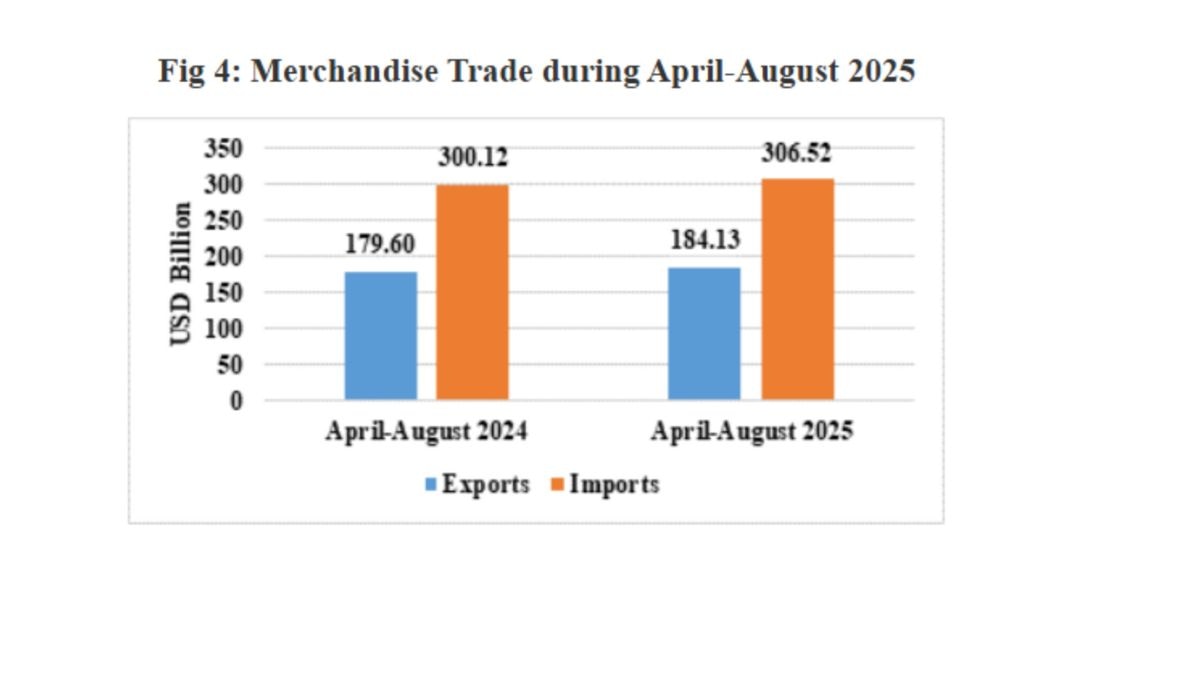

As a double whammy, surging imports of goods during August 2025, at $61.59 billion, kept India’s merchandise trade deficit high at $26.5 billion, much higher than the average of $23.7 billion seen during April-July 2025. As a silver lining, this is significantly lower than the year-ago level of $35.6 billion, which had been driven by an unusual surge in gold imports, as per ICRA Ratings.

Sharp dip in exports on anvil

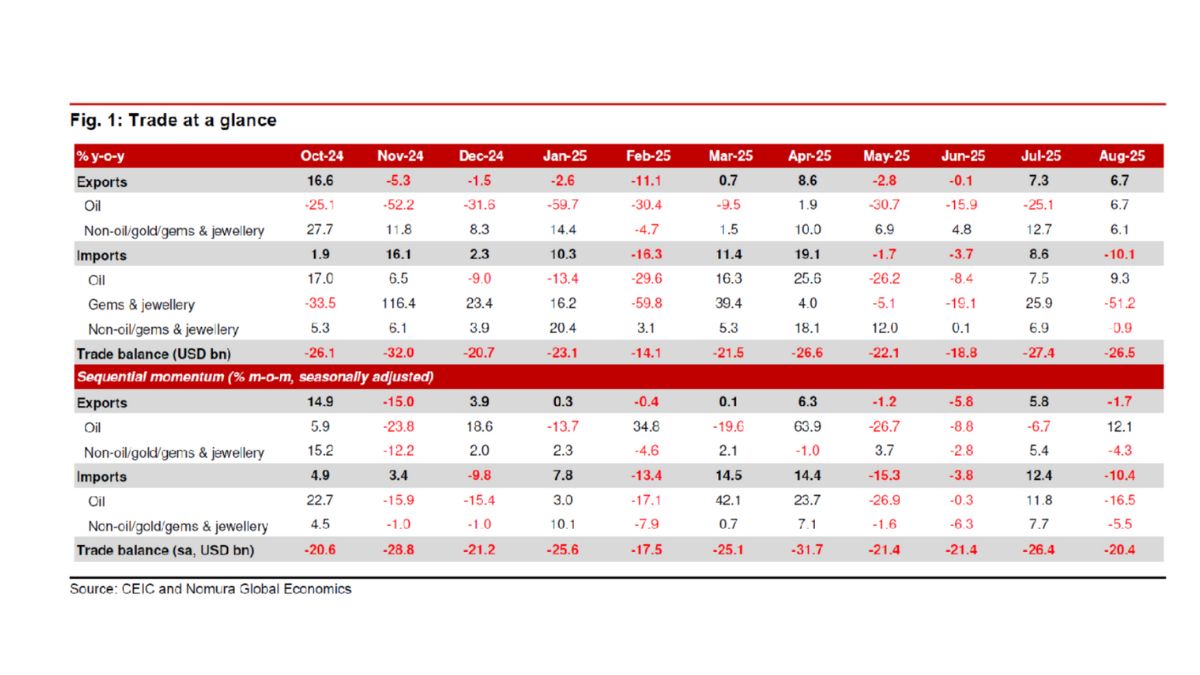

Attributing the 6.7 per cent exports growth in August to a low base, Aditi Nayar, Chief Economist, ICRA, confirmed the onset of the adverse effect of tariffs on India’s exports to the US, which slowed to a nine-month low of 7.2 per cent from 25 per cent in the first seven months of 2025, as the penalties rained down on US-bound shipments. “The penalty is likely to drive down exports to the US materially in September 2025, which should lead to a sharp dip in overall exports, while also pushing up the trade deficit in the month,” cautioned Nayar. (See Fig 1)

A matter of concern to Nomura economists Sonal Varma and Aurodeep Nandi is that there are no signs of export frontloading while core imports weaken. “Export growth in August 2025 moderated from 7.3 per cent in July this year, weaker than expected, while import growth reversed from the 8.6 per cent growth in July. Growth in US-bound shipments weakened to 7.1 per cent y-o-y (from double-digit growth so far), again suggesting no frontloading and instead implying the impact of higher tariffs is already (partly) visible in the export data. This is a surprise, as we expected some frontloading in August and the tariff impact to be visible from the September shipments onwards,” said Varma and Nandi.

The slowdown interestingly reflects on the shift in the pecking order of India’s top five export destinations, in terms of change in value, which exhibited positive growth in exports in August 2025. Amid tariff uncertainty, though the US emerged among the top five export destinations, followed by China, UAE, Hong Kong and Germany.

Commerce Ministry data on Monday showed that compared to August 2024, the United Arab Emirates shot past the US with 23.42 per cent, with the US at 7.15 per cent. The other three high export destinations were the Netherlands, China and Hong Kong. India’s top five export destinations recording positive growth in the April–August 2025 period vis-à-vis the corresponding months of 2024 show the US ahead with 18.06 per cent and UAE at 6.53 per cent. Hong Kong accounted for 26.19 per cent of the value of India’s exports, China 19.82 per cent and Germany 11.73 per cent.

In the import category as well, in August 2025, the US is starkly missing in India’s top five countries — in terms of change in value — exhibiting growth, even though it figures among the top five importers in the April–August 2025 period, a sign that the levies have started to bite. The other importers exhibiting growth in August 2025 were Russia, Saudi Arabia, Ireland, Iraq and Qatar.

Exporters pin hope on key sectors

While bracing for tariffs to make their real landfall, industry and trade are maintaining guarded hope. Federation of Indian Export Organisations President SC Ralhan found a welcome and encouraging sign in the 6.7 per cent y-o-y growth in exports for August 2025, especially in light of ongoing global headwinds and geopolitical uncertainties. “Importantly, decline in imports by 10.12 per cent to $61.59 billion, from $68.53 billion in the corresponding period last year, has also helped in easing the trade deficit, which is now significantly lower compared to the same month last year,” said Ralhan. (See Fig 2)

The optimism is not entirely misplaced, finding ground in healthy cumulative exports growth in April–August 2025 and narrowing of the trade gap, aided by Government efforts at diversification of export markets and focus on high-growth sectors to spur positive momentum. “India’s overall exports (merchandise and services) increased by 6.2 per cent from $329.03 billion during April–August 2024 to $349.35 billion during April–August 2025, driven by higher non-petroleum and non-gems and jewellery exports during the same period,” said Hemant Jain, President, PHDCCI. The non-petroleum and non-gems and jewellery basket comprises gold, silver and precious metals, the exports of which jumped in August 2025 to $28.31 billion compared to $26.68 billion in August 2024.

Besides, services trade, which has been demonstrating sustained growth and resilience, offers a substantial buffer against the headwinds. The estimated value of services exports for August 2025 is $34.06 billion as compared to $30.36 billion in August 2024, while the estimated value of services imports for August 2025 is $17.45 billion as compared to $16.46 billion in August 2024. Services exports also grew by 10.57 per cent during April–August 2025 over April–August 2024.

Moreover, some of India’s other major drivers of merchandise exports growth in August 2025, including those driven by the US market like engineering goods, recorded positive growth in August 2025 “despite uncertainties posed by US tariffs and several other challenges”, as Pankaj Chadha, Chairman of the Engineering Exports Promotion Council, emphasised. “It is encouraging that engineering goods exports increased by 4.91 per cent from $9.44 billion in August 2024 to $9.90 billion in August 2025 (as per Government data) and on a cumulative basis too, during the April–August period of 2025, these exports grew by 5.84 per cent y-o-y to $49.24 billion,” added Chadha. Gems and jewellery exports, another key attraction for the US, increased by 15.57 per cent from $2 billion in August 2024 to $2.31 billion in August 2025.

Among other shipments which displayed y-o-y growth in August 2025 are electronic goods, which increased by 25.93 per cent from $2.32 billion in 2024 to $2.93 billion, and drugs and pharmaceuticals, with an uptick of 6.94 per cent from $2.35 billion in August 2024. While India’s pharmaceutical sector has exports reaching over 200 countries, including major, highly regulated markets like the US and the EU, India is also a significant player in the global pharma machinery market projected to reach $27 billion by 2030, with Indian machinery exported to over 100 countries and accounting for 35 per cent of the industry’s total revenue.

According to Vivek Jain, Director, Corporates, India Ratings & Research, while the US contributes around 35 per cent to the total revenue for leading Indian pharma companies, this proportion has been steadily declining over the past few years due to price erosion and its impact on margins and returns. “Any tariffs imposed would likely be largely passed on to end-consumers, with limited absorption by Indian pharma companies. Indian companies have a diversified revenue model, healthy balance sheet and no major risk to liquidity in the sector. Hence, any material impact from future tariffs to Indian pharma is highly unlikely,” assured Jain, who sees a short-term impact for the initial three to four months due to contracts, pricing, and efforts to maintain market share.

Signs of tariff blow

However, early signs of stress are beginning to take root due to the punitive tariffs imposed by the US, prompting a rush of meetings of exporters with the Government and Reserve Bank of India, urging reinstatement of the Interest Equalisation Scheme (IES), affordable export finance and relief to absorb part of the punitive tariff imposed by the US, India’s largest goods export destination, accounting for close to 20 per cent of total exports (at $86.5 billion) and 2.2 per cent of GDP in FY25.

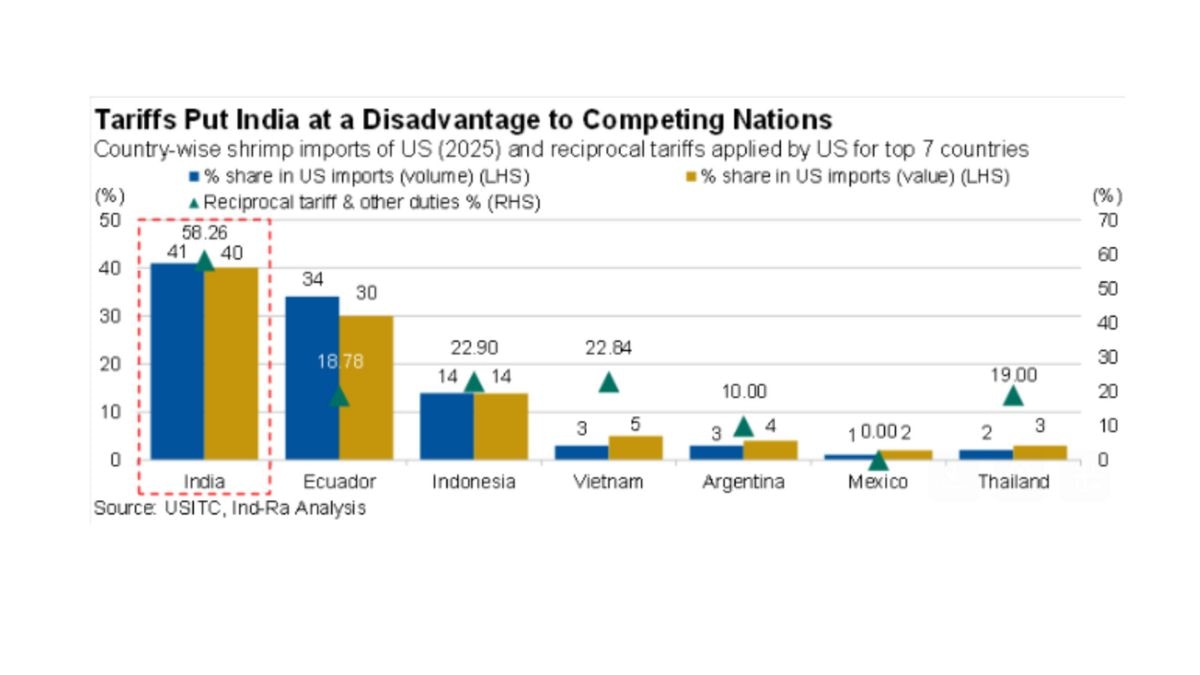

Key exports to the US include electronics, textiles, gems and jewellery, pharmaceuticals, chemicals, industrial machinery and other household items. “We expect higher tariffs to directly hit export orders in affected sectors, such as textiles, gems and jewellery, household items and seafood and likely be amplified for MSME units, which lack the financial capacity to withstand the tariff shock.”

Chadha highlighted the vulnerability of the engineering sector to the US tariffs. The average difference of duty between India and its competing nations is 30 per cent. India’s engineering exports to the US average around $20 billion, which constitutes approximately 45 per cent of the total exports from India that are exposed to US tariffs. “While the industry can absorb 15 per cent of the tariff, support is needed from the government for the remaining 15 per cent either in the form of scrip or by getting exchange conversion at the REER rate of exchange,” said Chadha.

The forecast from economists is no better. Considering that 50–60 per cent of India’s exports to the US (total merchandise exports to the US in FY2025: $87 billion) are at risk, the downside is likely to be material in case the 50 per cent tariff rate (25 per cent general + 25 per cent special) is continued until the end of FY2026, suggested ICRA’s Nayar. “Given this, India’s exports to the US are likely to contract during the remainder of the fiscal. In this scenario, we expect India’s overall merchandise exports to decline somewhat in FY2026 from the levels seen in FY2025,” predicted Nayar.

More help could be on the way, with DGFT Ajay Bhadoo acknowledging the loss of competitiveness due to rising tariffs and emphasising, at a meeting with FIEO, the Government’s commitment to supporting the export sector with steps underway to facilitate cheaper and easier access to export credit, efforts to enable international buyer-seller interactions, both by supporting Indian delegations abroad and by hosting foreign buyers in India, and encouragement for exporters to explore alternative and emerging markets, including Russia and others, to reduce dependency on a few trade partners.

Doonited Affiliated: Syndicate News Hunt

This report has been published as part of an auto-generated syndicated wire feed. Except for the headline, the content has not been modified or edited by Doonited