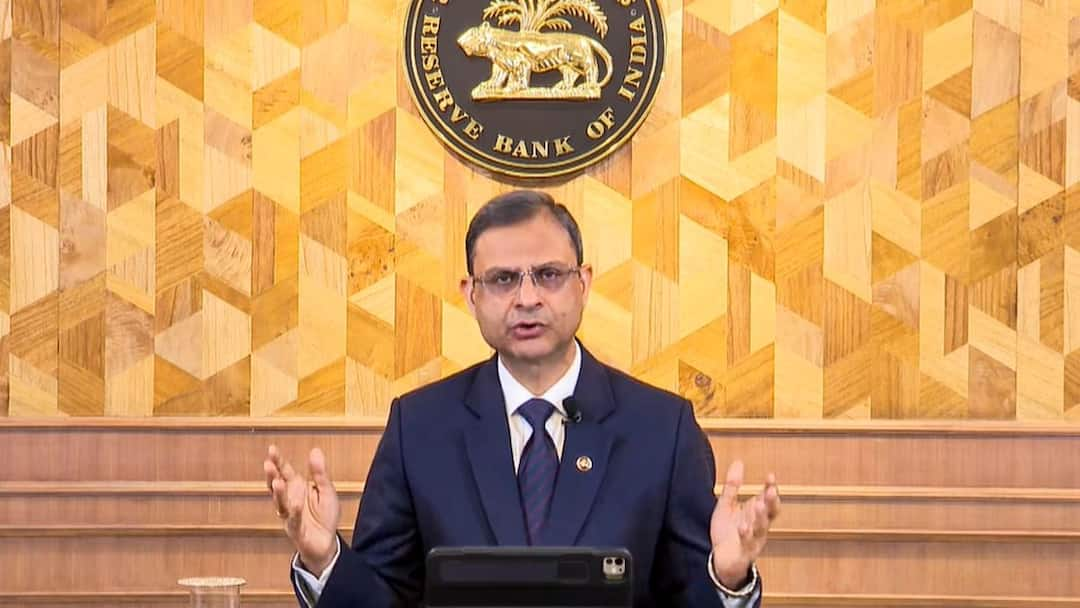

The Reserve Bank of India (RBI) Governor, Sanjay Malhotra, noted during the RBI Monetary Policy Committee meeting announcements on Wednesday that food inflation has turned positive, while inflation expectations have sharply declined, moving forward. For the financial year 2025-26, the Consumer Price Index (CPI) inflation is projected at 4 per cent, with quarterly estimates of 3.6 per cent for Q1, 3.9 per cent for Q2, 3.8 per cent for Q3, and 4.4 per cent for Q4. Governor Malhotra also stated that the risks surrounding these projections are considered to be evenly balanced.

In its previous meeting, the MPC had maintained its inflation forecast at 4.2 per cent for FY26. Notably, India’s retail inflation had eased to a seven-month low of 3.61 per cent in February, with food inflation dropping below 4 per cent for the first time in nearly two years. Food inflation had further cooled to 3.75 per cent, marking its lowest level in 21 months, as vegetable prices fell by 1.1 per cent year-on-year.

“Headline inflation moderated during January-February 2025 following a sharp correction in food inflation.12 The outlook for food inflation has turned decisively positive. The uncertainties regarding rabi crops have abated considerably and the second advance estimates point to a record wheat production and higher production of key pulses over that last year.13 Along with robust kharif arrivals, this is expected to set the stage for a durable softening of food inflation. Sharp decline in inflation expectations in our latest survey for three months and one year ahead would also help anchor inflation expectations, going ahead.14 Furthermore, the fall in crude oil prices augurs well for the inflation outlook. Concerns on lingering global market uncertainties and recurrence of adverse weather-related supply disruptions, however, pose upside risks to the inflation trajectory, the governor said.

Also Read: RBI MPC Meeting LIVE Updates: Repo Rate Slashed By 25 Bps, Inflation Estimate For FY26 At 4 Per Cent

Repo Rate Update

Additionally, the central bank has shifted its stance from ‘Neutral’ to ‘Accommodative.’ The RBI has lowered its repo rate by 25 basis points to 6 per cent, following a similar 25-bps rate cut in February—the first rate reduction since May 2020. At that time, the RBI had slashed the repo rate to 4 per cent to support the economy amid the COVID-19 pandemic. Since then, the central bank has raised the repo rate seven times, bringing it to 6.5 per cent.

RBI Governor said, “First and foremost, uncertainty in itself dampens growth by affecting investment and spending decisions both of businesses and households. Second, the dent on global growth due to trade frictions will also impede domestic growth. Third, higher tariffs shall have a negative impact on net exports. The impact of relative tariffs, our relative tariffs vis some of the other countries are quite low. Then there is the unknown of the elasticities of our export and import demand and the policy measures adopted by us. India is very vigorously and proactively engaging with the US administration on the foreign trade agreement.”

Doonited Affiliated: Syndicate News Hunt

This report has been published as part of an auto-generated syndicated wire feed. Except for the headline, the content has not been modified or edited by Doonited