Indian equity markets extended their downward trajectory for the third straight week, with benchmark indices slipping below key psychological levels amid lukewarm Q1 FY26 earnings, particularly from IT and financial companies. Analysts attributed the sustained correction to weak earnings momentum and cautious forward guidance, which have dented investor sentiment.

The underperformance in the IT sector continued to be a drag on the markets, as global demand uncertainty and conservative outlooks from major players weighed heavily. Financials also remained under pressure, with expectations of net interest margin (NIM) compression and potential stress on asset quality.

“FMCG stocks, however, stood out, supported by positive earnings outlooks that suggest a revival in urban consumption. The combination of macroeconomic support and better guidance has shifted attention toward consumption-oriented sectors,” said Vinod Nair, Head of Research at Geojit Financial Services.

Indices End Below Key Thresholds

On Friday, the BSE Sensex dropped 501.51 points, or 0.61 per cent, closing at 81,757.73. The NSE Nifty declined 143.05 points, or 0.57 per cent, finishing the session at 24,968.40—slipping below the 25,000 mark.

Sector-wise performance reflected broad-based weakness. Barring Media and Metal, all sectoral indices ended in negative territory. The steepest declines were seen in Pharma, Private and PSU Banks, FMCG, Capital Goods, Consumer Durables, and Telecom, which dropped between 0.5 and 1 per cent.

Also Read: Gold Rate Today (July 19): Check Out Gold Prices In Delhi, Mumbai, Bengaluru, Ahmedabad, More Cities

Broader Markets And Global Signals

The selling wasn’t limited to large-caps. The Nifty Midcap and Smallcap indices fell 0.7 per cent and 0.8 per cent, respectively, indicating profit-booking across the board. Looking ahead, investors are awaiting a series of high-frequency data releases from India and the US. Domestically, the S&P Global Manufacturing PMI (Flash) for July will be closely watched for cues on industrial momentum.

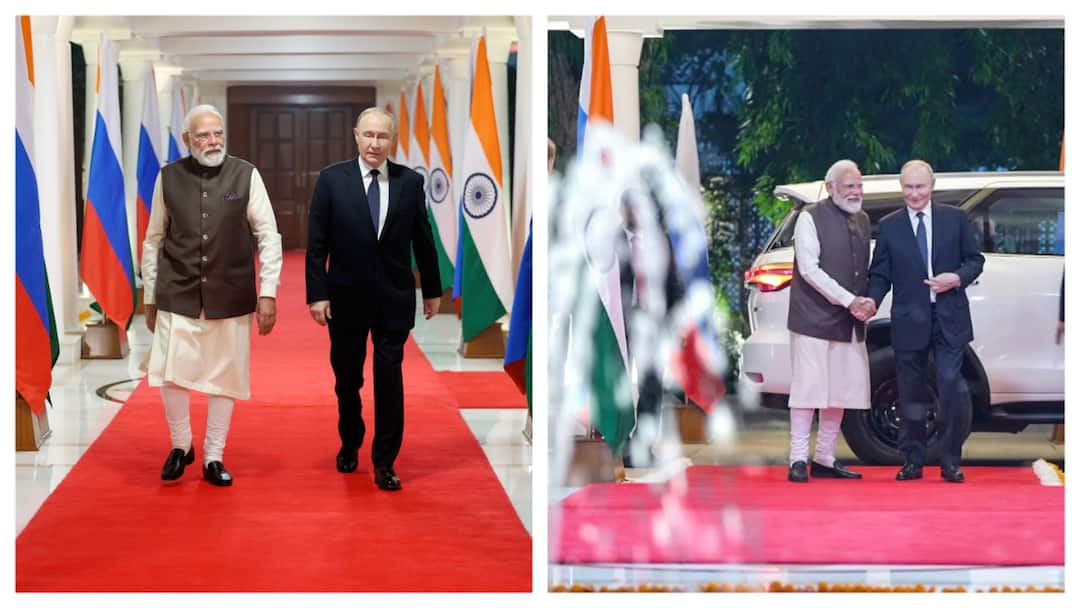

Globally, the outcome of the ongoing US-India trade discussions remains a key factor. A constructive resolution could support export-driven sectors and improve India’s standing among global investors, experts noted.

Doonited Affiliated: Syndicate News Hunt

This report has been published as part of an auto-generated syndicated wire feed. Except for the headline, the content has not been modified or edited by Doonited